“The US and other industrialized countries have committed themselves to giving 0.7% of their GDP in foreign aid. The United States is giving 0.15%…the amount of money we are giving Africa is [equivalent to] that of 10 days fighting in Iraq…much of the 0.15% is part of a geopolitical strategy and that includes a lot of money to Pakistan, money for reconstruction in Afghanistan, money for Egypt. So a lot of that money is part of the Camp David agreement. So after that if you look at the money given to poor countries to develop, it is miniscule.” (Joseph Stiglitz, The Asia Society 2011)

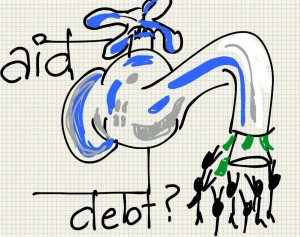

Although there is no longer any widespread misconception about foreign aid being doled out for altruistic reasons, it is important to explain just how strategically planned, and often counter-productive, the sanctioning of foreign aid has been for the goal(s) of ‘development’. These have exacerbated inequity. This post discusses the types of lending and the internationalization of ‘development’-related funding, and some examples of the costs borne by developing economies as a result of those machinations.

Strings Attached

Lending is either bilateral or multilateral, between governments or with private banks, private firms, investors, or supranational institutions. Grants and FDI do not create debt, and they’re the only alternatives that don’t (Sheppard, Porter, Faust and Nagar 2009).

When it comes to foreign aid, the motives, the long-term distribution of aid money, and the development vision are key to discerning whether or not ‘development’ goals are achieved. Consider motive– foreign aid is not simply allocated on the basis of need. Consider distribution– foreign aid mostly becomes “tied aid” or “food aid”, both resulting in a chunk of the money leaking back into the ‘donor’ nation by stipulations of necessitated product purchase (Sheppard, Porter, Faust and Nagar 2009). And even if this is stipulated for a specific duration of time, that time is likely sufficient to make the recipient population dependent on those products as well as inept at producing their own alternative produce. And finally, consider development vision– Sheppard, Porter, Faust and Nagar give examples of infrastructural projects like the Aswan Dam in Egypt, Green Revolution in India, shantytowns in Colombia, and transmigration resettlement program in Indonesia that were mired with unintended social and environmental side effects. Therefore, with respect to foreign aid, the motives, the long-term distribution of aid money, and the development visions have been dubious and/or counterproductive.

Hegemonic Capitalism

Although local knowledge is not necessarily superior, cost-benefit analyses by the First World investors are also subjective. The analyses are based “on economic assumptions stressing free competition”, suggesting that ‘development’ is only monetarily defined. In this case, one would call into question for instance, this vision of representative democracy perpetuated by the West that is not necessarily accompanied by the kind of economic growth that it is touted to facilitate. The issue of the Indian versus Chinese governance and economic models are an illustration of this discussion (refer to a TED talk by Yasheng Huang, and a TED blog on democracy). This market-oriented development ideology also serves as a reminder of the issues discussed (in a previous blog post) with respect to visualizing the poor as consumers.

Sheppard, Porter, Faust and Nagar talk about financial crises being a “latent, systemic issue in this era of globalized economic transactions”. The short-term, local economy-debilitating, and currency-devaluing nature of the stipulations of such loans became a sour point with the citizens in the countries of the Global South. This resulted in multiple loan defaults and “first world retaliation in other arenas such as trade embargoes or seizure of foreign exchange reserves”, which in turn exacerbated the problem, as a kind of negative cycle. David Harvey has spoken at length about the escalating international competition and the localized devaluation or geopolitical struggles that often result. Because of this kind of backfiring of loan deployments, the resulting disapproval from the lenders, and their coercing the debtors for even partial loan repayments, the situation worsened. Countries that already needed money, needed more money, and also needed to satisfy multiple agents that formed a sort of informal conglomerate of lenders, of their candidacy to borrow. For instance a “stamp of approval” by IMF and World Bank was needed to attract other lenders. How could that be feasible?! The situation unfolded much like that of house loans and second mortgages. So it came to be that supranational institutions and foreign governments gained ownership of economic activities or land in debtor nations, called debt-equity or debt-nature swaps.

Some of the crisis situations could have been averted without the crony capitalism of the hobnobbing between North-South elites. Capital flight from the elites’ reserves significantly exceeded the external debt by their countries, “so if the elites had invested at home, their countries would not be in debt” (Sheppard, Porter, Faust and Nagar 2009). The Tobin tax scheme that was conceptualized for the taxation of private financial capital in order to restrict international or inter-currency capital mobility, is accompanied by its own posse of tax evasion strategies. This again brings to mind the chasm between the claims and the reality of the “trickledown” concept. David Harvey has spoken (Penn Humanities Forum 2011) of the most recent example of this chasm, this double standard within the United States when referring to the billion-dollar “retention bonuses” given to executives post-collapse in 2009. He expressed distrust of any “resolution authority” that can regulate the “socializing of losses and privatizing of profits”, given the fact that previous regulatory legislations could not avert any of the financial crises. He suggested that the only solution is to not let lending institutions get “too big to fail”, so that they cannot rest on the presumption that bailouts will necessarily happen even if they take more risks than necessary with public investments. And this applies to international/transnational exchanges as well.

“Imperial Nature”

Even lending by supranational institutions is not devoid of a slew of side effects and counterproductive results. The two biggest issues with lending stipulations by these institutions are that of selective imposition of rigidity of conditions for borrowing (like the loose hand currently given to the United States), and the inequity-producing structural adjustment policies. SAPs included deflationary policies, export-oriented growth, and trade liberalization. Deflationary policies were counterproductive to the currency gaining standing in the world, a situation which was worsened by the increased expenditures on imports and not local industry, and the unrestricted spatial competition from trade liberalization that bedevilled those that in any case tried to contribute to developing local industry from the ground up. How such inequity propagation got sanctioned under the banner of ‘development’ is beleaguering in retrospect.

This is where Goldman’s Imperial Nature serves as a useful reference on the World Bank’s history, its focus on ‘development’ and ‘poverty’, and the resulting one-size-fits-all solutions and “eco-governmentality” propagated by the commoditizing of natural resources, and therefore, of public resources. The Bank was one of the Bretton Woods institutions, and under the Marshall Plan, “a social welfarist project deployed to jumpstart Europe’s capitalist economy through a large infusion of capital”. Following that, its image was redefined as one of postcolonial “public” banking that aimed to achieve ‘development’ in ‘underdeveloped’ parts of the world- the former colonies. In the initial stage, ‘development’ was synonymous with the modernization ethic, which meant that the economic paradigm was that of capitalism, so the focus was on “state fiscal austerity, market liberalization, public sector privatization”. When McNamara came to the helm, his expansionist agenda for the Bank’s portfolio debilitated many countries from the Global South within a decade. Ironically, he had set out to do the opposite. He intended to increase the borrowing and lending, so he both expanded his sources of capital, and invested in large-scale infrastructural projects to increase the borrowing. But while he planned for a development agenda that did not depend on trickledown, he had to find investment-worthy “commodities” in these countries he was focusing on for tackling poverty and underdevelopment. And this is when the Bank began delving into the commodification of nature-society relations to generate products and services to be utilized by global capital markets. In order to sell comprehensive public projects “as rational, politically and economically necessary, and profitable”, this commodification and rent-seeking behavious became necessary to get lenders on board. During this period, the Bank also developed its reputation for being a global data hub. Stiglitz, who had been the Bank’s Chief Economist at some point thereafter, viewed the modernization policies proposed by the Bank’s Elite sustainable development scholars as becoming “ends in themselves rather than means to more equitable and sustainable growth”.

The result of (1) the commodification of natural resources the world over, (2) the Bank’s accumulation of this ‘property’, and (3) the purely Bank-led, Bank-executed work in the countries of the Global South, civil society became divided. Countries that supported the Bank’s agenda fared better than others, and this disparity extended to civil society within nations as well: NGOs supporting the Bank fared well, while others did not. Job security became “linked to the longevity of a particular eco-development project, thus encouraging consent on controversial projects receiving World Bank or bilateral financing”. Besides this division, there was the issue of that Harvey calls “accumulation by dispossession” with respect to the natural and public resources, and the dispossession of indigenous communities. Through both the lure of income security and the accumulation by dispossession, civil society became stratified. And this stratification would get worsened if the loans mushroomed into debt which could not be repaid. Soon there were movements reflecting a cross section of people challenging development authorities on issues of right-to-livelihood, military repression, environmental destruction, and the privatization of natural resources and public goods, and the Gramscian “rise of civil society” found its way into the agendas of commercial and government agencies, development NGOs, and multilateral institutions like the Bank.

The Case of Jamaica

Most of these problems with bilateral and multilateral aid and trade are illustrated in the situation that unfolded in Jamaica from the 1970s to the 1990s. Given the oil embargo by OPEC, Third World countries needed to be given cash injections to pay for the high prices of oil imports. Loans were given to Jamaica for this purpose, but as illustrated by the testimonies of multiple individuals (Life & Debt 2001), what began as a means to salvage the situation only aggravated the problems and produced new ones.

To begin with, small sums of money were loaned over short time frames, and no support was granted for long term goals. How ‘development’ can be expected to be genuinely achieved with accelerated cash injections is beyond understanding. But the stipulations of lending reveal that single-nation ‘development’ was likely not the goal; rather it was to bolster the production capacity of Third World nations so that they could feed into a world market that was under the domain of supranational institutions with First World leaders at its helm. Given that these institutions are headed by either an official from the United States, or Europe, or both, any expectation of impartiality in decision-making would be misguided. Their focus seemed to have been on knowing who the money was owed to and why, which could be a tactic for shifting purchases to the United States and European markets.

There were restrictions imposed on spending so the focus was on imports and exports, with no allowances for health and education. This in turn ensured that a robust local economy would become a far cry because it ensured that the current population was dependent on imports, and that there would be no development of skills and no productivity in the future generation(s). With respect to the contention that focus was on exports just as much as imports, it is important to point out two things: first, there is the devaluing of currency that would cause imports to cost more than expected, and second, there is the constant wastage or rejection (based on “international standards”) of the products that the Jamaican farmers were forced to produce and sell at pre-determined prices that resulted in exports raking in less than expected. In all, the money flowing into Jamaica was significantly lower than what was expected. How was this the “level playing field” as was contended to be?

When second loans were taken out to pay for the initial loans, there had to be collateral. It came in the form of greater economic control to foreign investors, inviting a string of other problems of particular relevance to human rights, a critical component of what constitutes ‘development’: cheaper production was undertaken out of allegiance to shareholders, but at the cost of labour wages. At Chiquita, there were no labour unions, and the protests tat had been undertaken to voice against the wages and work conditions were overcome by artillery. When the Jamaican workers insisted on leaving, they were quickly replaced by Asian workers brought in from rural China, and the government could do nothing about it. Eventually, the facilities were closed down.

National debt, resource wastage, multiple loans and collaterals, capital flight, eco-governmentality, and social unrest- this is the legacy of globalized economic transactions. And each is associated with gross inequity.